Ethanol Market Overview

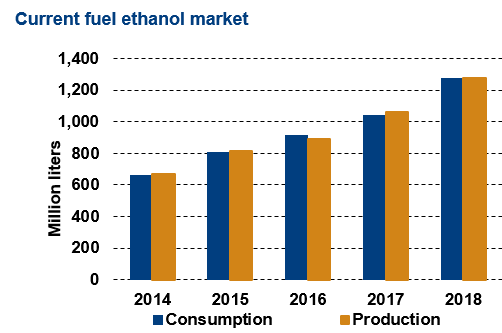

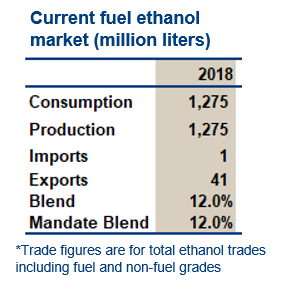

- Fuel ethanol consumption in Argentina reached 1.2 billion liters in 2018 driven by strong government support and tax incentives for domestic oriented producers.

- Consumption is restricted to internal output with negligible room for ethanol trade.

- Producers benefit from set prices, tax incentives and supply quotas resulting in growing supply in recent years. Capacity has grown rapidly over recent years, reaching 1.2 billion liters in 2018. Feedstock use is split between corn and sugarcane.

- The government hopes to move toward a market similar to Brazil where high ethanol blends are available at the pump, but require significant infrastructure investment.

Key Facts

- Mandate:

2018 12% - Ethanol consumption:

2018 1.2 billion liters (12.0% blend) - Capacity: 1.25 billion liters

- Ethanol plants: 16 (feedstocks: sugarcane & corn)

- Gasoline consumption forecast:

2022 12.7 billion liters

Policy

- Argentina first passed legislation to promote the production and use of biofuels in 2006. Ethanol blending mandates were first established in 2010 at 5% increasing to reach a nationwide blend of 12% in 2016. To encourage the use and production of biofuels the government also offers a number of tax incentives which are not available for ethanol produced for export.

- The ethanol market is tightly controlled with prices, supply, demand and export quotas set by the government. These regulations, combined with import tariffs, leave no opportunity for ethanol trade in Argentina. Without trade, consumption is restricted to domestic supplies which has resulted in Argentina not meeting its blending mandate in recent years.

- Domestic ethanol producers have petitioned the government to increase the national blend from E12 to E15 and eventually E20, however this is resisted by the automotive sector. Argentina is an active participant of the Paris Agreement and targets a reduction in GHG emissions of 15% by 2030 compared to a business-as-usual scenario with potential to increase the target to 30% if international funding and support is available. The government is planning to use biofuels as part of a range of actions to meet this goal.

Market Challenges

- Growth in consumption of non-local ethanol is restricted by existing trade barriers to imports into Argentina.

- While strong policy support has boosted the industry so far, the financial and administrative burden of supporting local ethanol production may see support wane in the future.

Trade

- Given the strict regulations governing the fuel ethanol market there is very little ethanol trade in Argentina.

- Ethanol imports from outside the Mercosur area incur a 20% tariff. Mercosur members are Argentina, Brazil, Paraguay, and Uruguay.

- Ethanol exports are minimal as domestic prices are typically set above world prices and ethanol for export does not receive tax incentives available for domestically used ethanol.

- By restricting trade, the government has limited consumption to domestic output and mandates have not been met in the past.