Supply/Demand Basics

-Largest animal feed market in Southeast Asia, producing over 30 MMT.

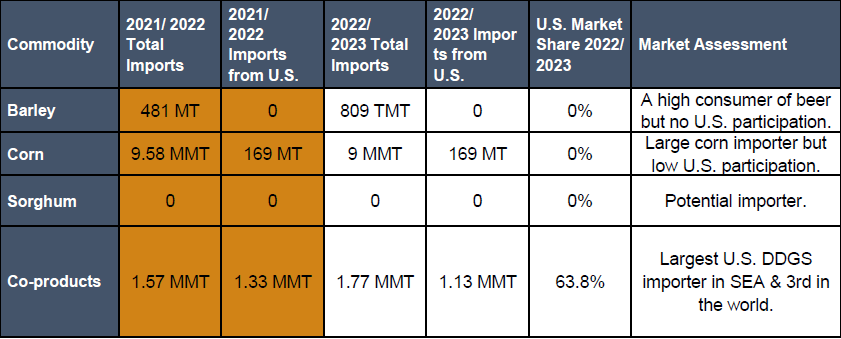

-Largest corn importer in Southeast Asia, importing 9.5 MMT in 2022/23 and11.2 MMT in MY 2023/2024.

-Imports over 4-5 MMT of feed wheat annually – for food and feed usage.

-Third largest importer of DDGS in MY 2022/2023 at 1.11 MMT.

-ASF is prompting the swine industry to transition from backyard operations to large modern commercial farms, boosting compound feed demand.

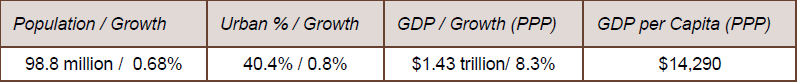

Country Overview

-Median age of 32.8 years old.

-Vietnam’s GDP is projected to grow at 6% in 2024.

-Manufacturing and exports rebounded in H2 2023, with further recovery expected.

-Increasing food prices presents a risk of higher CPI.

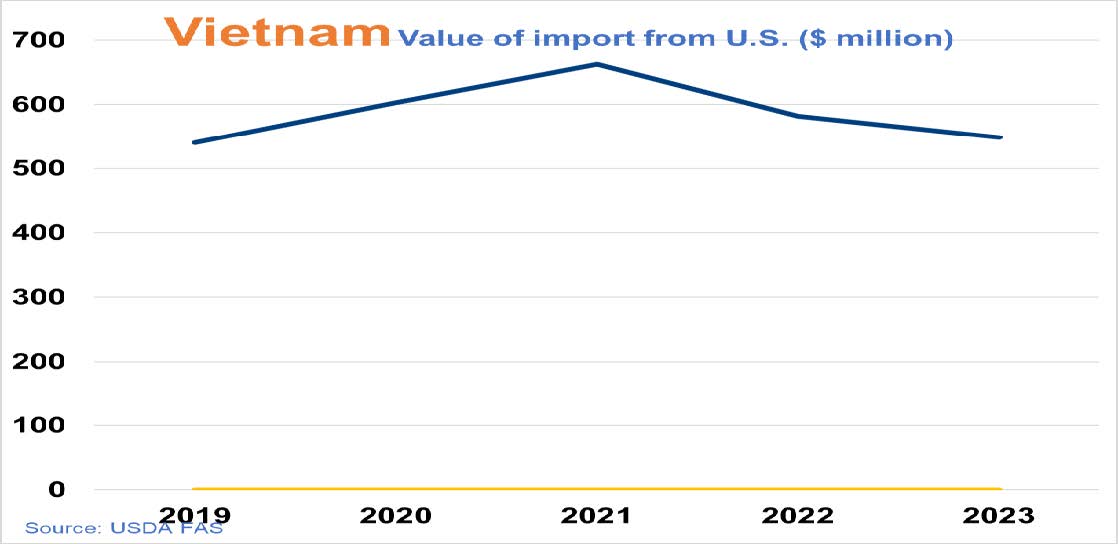

Trade and Market Share Overview

-U.S. DDGS losing market share amid increasing competition from Brazil.

-Relatively low buyer sophistication with medium counterparty credit risk.

-Large unofficial cross-border trade with China in all sectors.

-Fumigation requirements hinder U.S. DDGS export potential.

-Detections of Canadian Thistle have threatened a market closure of soybeans and wheat.

Policy Overview

-2% corn tariff (reduced in 2021 from 5%).

-0% tariff on CGM/DDGS.

-Import permit is no longer required for U.S. DDGS.

-Phosphine gas fumigation at the origin is necessary for DDGS.

-Vietnam is one of the few GMO cultivating countries in Asia.